Eventos

3rd Annual Meeting Colombian Economics Conference

Fecha:

De 15 de Diciembre de 2025 hasta 16 de Diciembre de 2025

Lugar: Universidad de los Andes

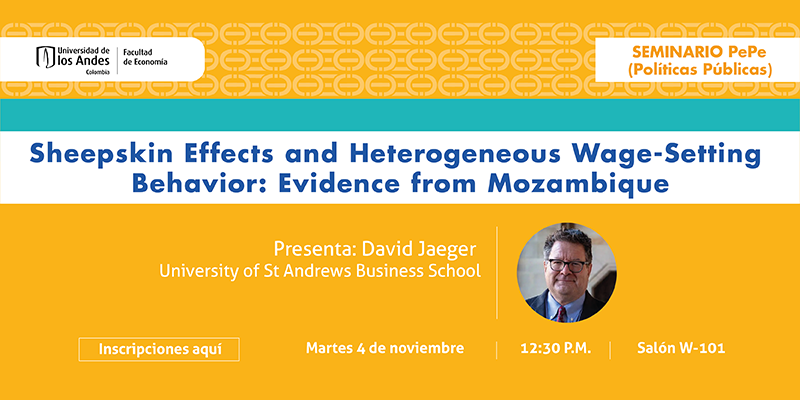

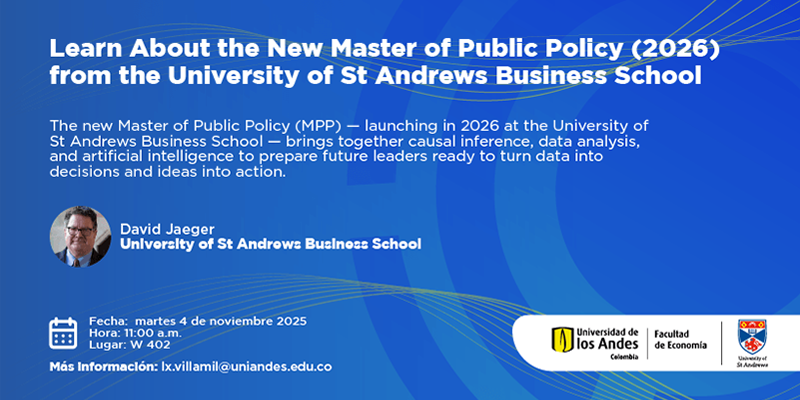

Learn About the New Master of Public Policy (2026) from the University of St Andrews Business School

Fecha:

04 de Noviembre de 2025

Lugar: Salón W-402