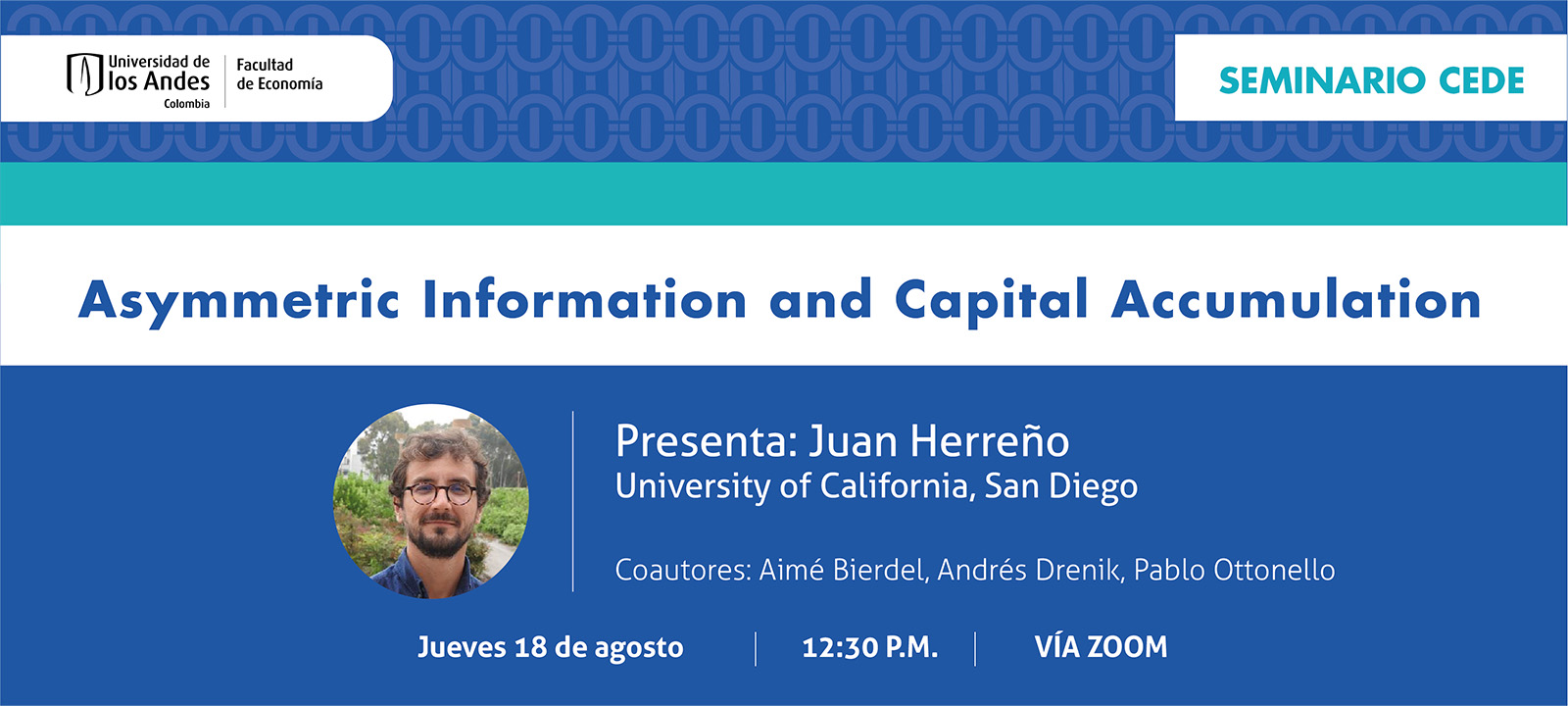

Seminario CEDE - Juan Herreño

We study the macroeconomic implications of asymmetric information in capital markets. We build a general-equilibrium capital-accumulation model in which capital is traded in decentralized markets, with sellers having more information about capital quality than buyers. Asymmetric information distorts the terms of trade for sellers of high-quality capital, who list higher prices and are willing to accept lower trading probabilities to signal their type. Led by the model’s predictions, we propose an identification strategy to measure the degree of asymmetric information based on the relationship between listed prices and selling probabilities and apply it using a unique dataset on a panel of individual capital units listed for trade. By combining the model and empirical measurement, we show that the degree of asymmetric information has quantitatively large effects on aggregate income levels and operates through three channels: aggregate investment, capital unemployment rate, and average quality of employed capital.